"The Boring Middle" - Summary and Our Take

Last week we read a very interesting article by Aanya Desai “The ‘Boring Middle’: Why Most Investors Quit Right Before They Get Rich”.

Last week we read a very interesting article by Aanya Desai “The ‘Boring Middle’: Why Most Investors Quit Right Before They Get Rich”. Article link below.

https://www.financialexpress.com/money/insights/the-boring-middle-why-most-investors-quit-right-before-they-get-rich/4056048/

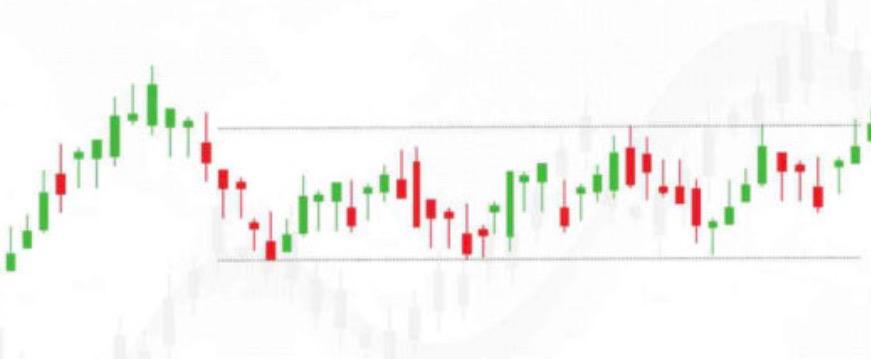

In this article, Aanya describes a critical but overlooked stage in the wealth-building journey: the “boring middle.” This is the long period where progress is real but emotionally invisible. Numbers grow slowly, compounding hasn’t hit momentum, and external life looks unchanged.

During this phase:

You are putting in real effort, saving, investing, budgeting, but your lifestyle looks no different.

Progress feels insignificant compared to long-term goals (e.g., ₹5–15 lakhs vs. dreaming of ₹1 crore+).

Compounding is still warming up; most growth comes from your own contributions.

Motivation fades, self-doubt surges, and many investors stop SIPs or withdraw funds, often right before compounding accelerates.

Yet this “invisible phase” is where discipline, temperament, and long-term thinking are forged.

Eventually, returns overtake contributions, growth speeds up dramatically, and the world finally notices, long after the real work is done.

Desai’s core message: Wealth is built quietly during the years no one applauds. Most investors leave too early. Those who endure, win.

ARKa’s Perspective: What This Means for Long-Term Investors

At ARKa Invest, we see this “boring middle” every day, in markets, in client behavior, and in portfolio outcomes. Our data shows that the investors who succeed are not the ones who predict markets, but the ones who persist in them.

Here's our take:

1. The boring middle is not a bug, it's the system working.

Compounding is asymmetrical. For long stretches, it will look like nothing is happening. This is normal. Markets reward patience, not excitement.

2. The invisible phase builds the habits required for wealth stewardship.

If investors got big returns early, many wouldn’t have the discipline or emotional resilience to handle volatility later.

The middle years train you.

3. The biggest risk isn’t volatility, it’s quitting.

Every market cycle shows the same pattern:

More wealth is lost through stopping SIPs than through short-term market declines.

4. Comparison kills progress.

Early-stage investors often compare their ₹10–20 lakh corpus to someone else's ₹3–5 crore portfolio.

But the compounding curves behind those larger portfolios always involved a decade-long boring middle.

How to Cope with the ‘Boring Middle’ (ARKa Invest Recommended)

Think of this phase like a midlife crisis, a moment where patience is tested, identity is questioned, and clarity becomes essential. Here’s how to push through it:

1. Automate everything

SIPs, asset allocation, rebalancing.

The less you rely on willpower, the easier the journey becomes.

2. Track behaviours, not just numbers

Celebrate the inputs (monthly investing, budgeting discipline), not just the portfolio value.

Your behaviour is the compounding engine.

3. Create “milestone check-ins”

Instead of checking your portfolio weekly, evaluate progress every 6–12 months.

Long-term investing requires long-term intervals.

4. Reduce comparison exposure

Mute the noise, social media, hype stocks, quick-rich stories.

Focus on your trajectory.

5. Treat the boring middle like strength training

Just like midlife is where emotional maturity develops, this phase builds financial maturity.

Slow growth ≠ no growth.

6. Use volatility as a psychological reset

Down markets often give investors a strange paradox:

They feel more motivated because discounts create obvious value.

Use corrections to reaffirm your long-term plan rather than panic.

7. Remember your “Why”

Your long-term goals, freedom, security, dignity, options, matter more than short-term feelings.

Revisit them regularly.

8. Trust the math, not the mood

Compounding is not emotional.

It doesn’t care if you’re bored.

It only needs one thing: time invested.

The boring middle is not the valley of disappointment.

It’s the foundation of transformation.

If you stay long enough, stay disciplined enough, the quiet years eventually give way to exponential acceleration. By the time the world applauds, the hardest part is already behind you.

Keep investing.

Keep showing up.

Your curve hasn’t gone vertical yet - but it will.